The Future of Next-GEN Investment Products in India is HERE !

The Future of Next-GEN

Investment Products in India is HERE !

The Future of Next-GEN

Investment Products in India is HERE !

The Future of Next-GEN

Investment Products in India is HERE !

#Disrupting Wealth Management

#Disrupting Wealth Management

Let's Keep It Simple!

We make some of the Best Financial Products in the Country

We make some of the Best Financial Products in the Country

#Disrupting Wealth Management

Let's Keep It Simple!

We make some of the Best Financial Products in the Country

#Disrupting Wealth Management

Let's Keep It Simple!

We make some of the Best Financial Products in the Country

Trusted by industry leaders

Trusted by industry leaders

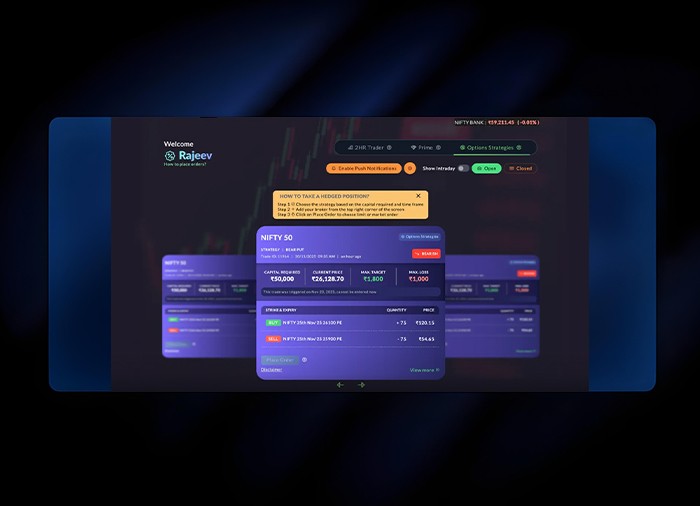

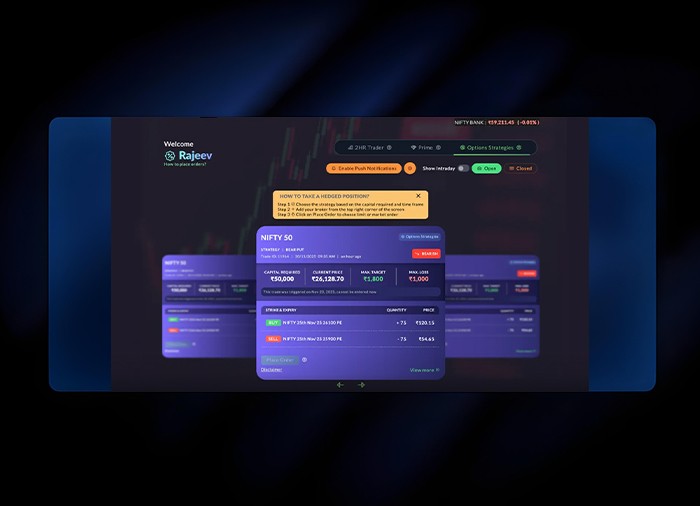

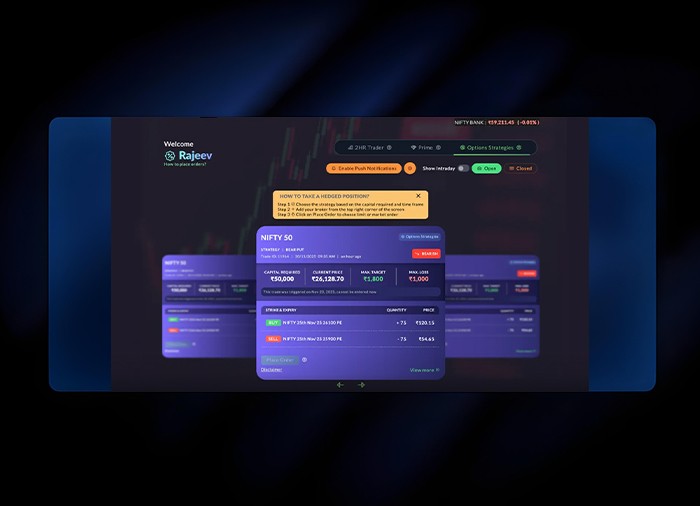

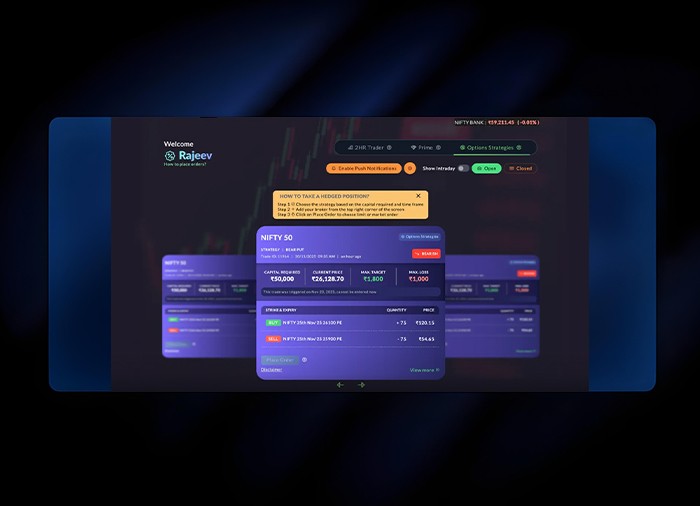

Start of the Art in

Every Way

Start of the Art in

Every Way

Octanom is a multi-asset quantitative investment firm, specializing in technology-driven, quantitative structured Products & Strategies leveraging derivatives to deliver protection, consistency, and an edge in today’s dynamic markets. Headquartered at BKC, Mumbai, with four offices across two key cities, ensuring robust coverage and accessibility.

Our Team: A handpicked team of 100+ professionals with over 200 years of combined expertise in investment and trading research.

Octanom is a multi-asset quantitative investment firm, specializing in technology-driven, quantitative structured Products & Strategies leveraging derivatives to deliver protection, consistency, and an edge in today’s dynamic markets. Headquartered at BKC, Mumbai, with four offices across two key cities, ensuring robust coverage and accessibility.

Our Team: A handpicked team of 100+ professionals with over 200 years of combined expertise in investment and trading research.

Octanom is a multi-asset quantitative investment firm, specializing in technology-driven, quantitative structured Products & Strategies leveraging derivatives to deliver protection, consistency, and an edge in today’s dynamic markets. Headquartered at BKC, Mumbai, with four offices across two key cities, ensuring robust coverage and accessibility.

Our Team: A handpicked team of 100+ professionals with over 200 years of combined expertise in investment and trading research.

Zerodha

Jainam

Upstox

Dhan

Choice

Axis

Arihant

Icici

Jainam

Upstox

Dhan

Choice

Axis

Icici

Paytm

Arihant

Multi-Broker Intergration

0

95%

100

One Click Order Execution

Multiple Technology Parameters to Track Markets

Analytics

AI to Detect Trend

Automated Agreement Process

0100010011101100100111000110011001001001000100001110100111101000100111010010010100100101000100010001101000100111011001001110001100110010010010001000011101001111010001001110100100101001001010001000100011010001001110110010011100011001100100100100010000111010011110100010011101001001010010010100010001000110100010011101100100111000110011001001001000100001110100111101000100110010010100100101000100010001101000100111011001001110001100110010010010001000011101001111010001001110100100101010010100010001000110100101001001010001000100011010001001110110010011100011001100100100100010000111010011110100010011101001001010010010100010001000110100010011101100100111000110011001001001000100001110100111101000100110010010100100101000100010001101000100111011001001110001100110010010010001000011101001111010001001110100

Privacy and Security

Our Segments

Our Segments

Whether you are an individual investor or a large family office we have custom products for everyone

Whether you are an individual investor or a large family office we have custom products for everyone

For Individual Investors

Products for everyday traders and investors seeking hedged strategies with low risk for both - regular income as well as long term wealth

For HNI Investors

Tired of the same Mutual Funds, PMS’s and AIF’s? Some seem to have high drawdowns, and some keep you locked in for 3 years minimum! It's time to make some Hedged styled alpha, irrespective of Market direction.

Wall of love

Wall of love

What our customers and supporters say

What our customers and supporters say

What stands out: (1) SEBI-registered and compliant, (2) Sophisticated hedging strategies, (3) Transparent fee structure, (4) No 'guru' nonsense - just quantitative methods. Been with them for a year. The app has improved significantly with updates. Only wish: more customization options for risk parameters.

Sanjay T.

What stands out: (1) SEBI-registered and compliant, (2) Sophisticated hedging strategies, (3) Transparent fee structure, (4) No 'guru' nonsense - just quantitative methods. Been with them for a year. The app has improved significantly with updates. Only wish: more customization options for risk parameters.

Sanjay T.

What stands out: (1) SEBI-registered and compliant, (2) Sophisticated hedging strategies, (3) Transparent fee structure, (4) No 'guru' nonsense - just quantitative methods. Been with them for a year. The app has improved significantly with updates. Only wish: more customization options for risk parameters.

Sanjay T.

What stands out: (1) SEBI-registered and compliant, (2) Sophisticated hedging strategies, (3) Transparent fee structure, (4) No 'guru' nonsense - just quantitative methods. Been with them for a year. The app has improved significantly with updates. Only wish: more customization options for risk parameters.

Sanjay T.

Good experience so far. The quantitative approach and focus on downside protection are exactly what I was looking for. App is functional and reporting is detailed. One suggestion: more granular controls for risk preferences within the app. Also, the initial consultation could be more streamlined. But the core product is strong.

Ritu S.

Good experience so far. The quantitative approach and focus on downside protection are exactly what I was looking for. App is functional and reporting is detailed. One suggestion: more granular controls for risk preferences within the app. Also, the initial consultation could be more streamlined. But the core product is strong.

Ritu S.

Good experience so far. The quantitative approach and focus on downside protection are exactly what I was looking for. App is functional and reporting is detailed. One suggestion: more granular controls for risk preferences within the app. Also, the initial consultation could be more streamlined. But the core product is strong.

Ritu S.

Good experience so far. The quantitative approach and focus on downside protection are exactly what I was looking for. App is functional and reporting is detailed. One suggestion: more granular controls for risk preferences within the app. Also, the initial consultation could be more streamlined. But the core product is strong.

Ritu S.

Finally found an investment platform that understands what HNIs actually need. Not interested in stock tips or get-rich-quick schemes. Hedged's focus on risk-managed wealth creation aligns perfectly with my goals. The educational content helped me understand their methodology. App is professional, reporting is detailed, team is accessible.

Deepa N.

Finally found an investment platform that understands what HNIs actually need. Not interested in stock tips or get-rich-quick schemes. Hedged's focus on risk-managed wealth creation aligns perfectly with my goals. The educational content helped me understand their methodology. App is professional, reporting is detailed, team is accessible.

Deepa N.

Finally found an investment platform that understands what HNIs actually need. Not interested in stock tips or get-rich-quick schemes. Hedged's focus on risk-managed wealth creation aligns perfectly with my goals. The educational content helped me understand their methodology. App is professional, reporting is detailed, team is accessible.

Deepa N.

Was skeptical at first - too many platforms promise sophisticated strategies and deliver generic portfolios. Hedged is different. The quantitative approach is genuine, the risk management framework is well-thought-out, and the execution is systematic. App interface is clean and functional. Customer support actually understands finance, not reading from scripts.

Anjali K.

Been using Hedged for 6 months now. What I appreciate most is the transparent approach to risk management. The app clearly shows how strategies are designed to work across different market conditions. Portfolio tracking is excellent, and the team is responsive when I have questions. Worth it for serious investors who want more than just mutual fund recommendations."

Rajesh M.

By Octanom Tech Pvt. Ltd

SEBI Registered RA INH000009825

CIN Number U74999MH2021PTC365248

BSE Enrollment Number 5586

Type of Registration: Corporate

Validity of Registration: June 13,

2022 – Perpetual

Have Questions?

In case you have any doubts or queries, kindly reach out to us on the below email address contactus@octanom.com

Inbox

Terms-of-use Client

Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. https://smartodr.in/ SEBI SCORES 2.0: https://scores.sebi.gov.in/ SEBI Corresponding Local Office Address: Securities and Exchange Board of India, SEBI Bhavan II, Plot No: C7, “G” Block, Bandra Kurla Complex, Bandra (East), Mumbai-400051

By Octanom Tech Pvt. Ltd

SEBI Registered RA INH000009825

CIN Number U74999MH2021PTC365248

BSE Enrollment Number 5586

Type of Registration: Corporate

Validity of Registration: June 13,

2022 – Perpetual

Have Questions?

In case you have any doubts or queries, kindly reach out to us on the below email address contactus@octanom.com

Inbox

Terms-of-use Client

Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. https://smartodr.in/ SEBI SCORES 2.0: https://scores.sebi.gov.in/ SEBI Corresponding Local Office Address: Securities and Exchange Board of India, SEBI Bhavan II, Plot No: C7, “G” Block, Bandra Kurla Complex, Bandra (East), Mumbai-400051

By Octanom Tech Pvt. Ltd

SEBI Registered RA INH000009825

CIN Number U74999MH2021PTC365248

BSE Enrollment Number 5586

Type of Registration: Corporate

Validity of Registration: June 13,

2022 – Perpetual

Have Questions?

In case you have any doubts or queries, kindly reach out to us on the below email address contactus@octanom.com

Inbox

Terms-of-use Client

Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. https://smartodr.in/ SEBI SCORES 2.0: https://scores.sebi.gov.in/ SEBI Corresponding Local Office Address: Securities and Exchange Board of India, SEBI Bhavan II, Plot No: C7, “G” Block, Bandra Kurla Complex, Bandra (East), Mumbai-400051

By Octanom Tech Pvt. Ltd

SEBI Registered RA INH000009825

CIN Number U74999MH2021PTC365248

BSE Enrollment Number 5586

Type of Registration: Corporate

Validity of Registration: June 13,

2022 – Perpetual

Have Questions?

In case you have any doubts or queries, kindly reach out to us on the below email address contactus@octanom.com

Inbox

Terms-of-use Client

Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. https://smartodr.in/ SEBI SCORES 2.0: https://scores.sebi.gov.in/ SEBI Corresponding Local Office Address: Securities and Exchange Board of India, SEBI Bhavan II, Plot No: C7, “G” Block, Bandra Kurla Complex, Bandra (East), Mumbai-400051